employer contribution to epf

And a break up of your salary will show Employer contribution to NPS or some such. Cash RM500 maximum cheque at a ll EPF counters in state capital including KWSP Muar.

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost

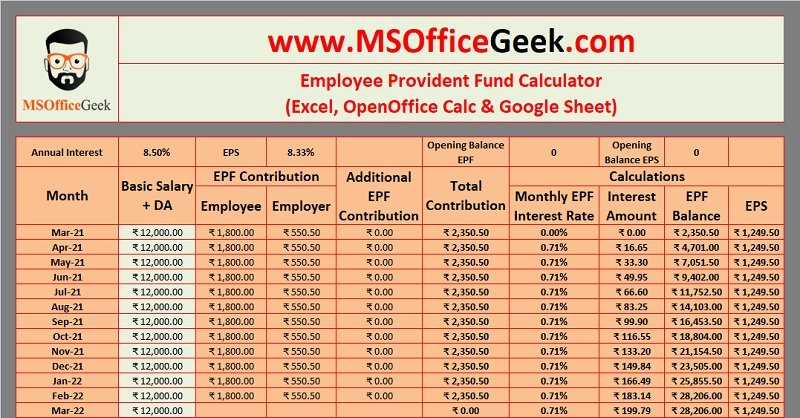

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

. Check your Form 16 See our GUIDE to understand form 16 here Your Form 16 will look like this. However this 12 is further subdivided into. Provide salary statements to employees.

Scam Alert Keep abreast of the latest scams. Cash RM500 maximum cheque at a ll EPF counters in state capital including KWSP Muar. EPF members in the private and non-pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers.

The employers contribution and employees contribution required to be deposited by the employer. Employees Provident Fund EPF 367. Contribution by an employee Contribution towards EPF is deducted from the employees salary.

Ownership of Transfer Form KTN 14A in the name of the new owner completed by the Land Office or at least a completed and signed Ownership of Transfer Form KTN 14A with the submission receipt by the Land Office. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas. The Supreme Court observed that employers have to deposit the employees contribution towards EPFESI on or before the due date for availing deduction under Sections 361va and 43B of the Income Tax Act 1961.

WHAT YOU NEED TO KNOW. Not applicable to members that receive a fixed employer contribution. Up to 14 working days may be needed before contribution is reflected in your statement.

Employee As monthly remuneration including all liable payments as mentioned above stands at RM6250. Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee. Employment is a relationship between two parties regulating the provision of paid labour services.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. How to check if your taxable salary includes employers contribution to pension account. 07 OCT INFO EPF RECORDS RM27 BILLION GROSS INVESTMENT INCOME FOR 1H 2022.

Access to internet banking makes EPF contribution payments much easier now. Government contribution is limited to members who are below age 60. Not applicable to members that receive a fixed employer contribution.

Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only Remaining amount wil go to Difference Question 1. Employers responsibility on EPF contribution. KWSP 6A 1 Self Contribution.

Register Self Contribution - Non-Domiciles EPF Employer KWSP 16GM Register Self Contribution - Government Incentives i-SaraanKasih Suri Keluarga Malaysia KWSP Contribution. Up to 14 working days may be needed before contribution is reflected in your statement. Employer has to make a contribution of 12 and employees contribution of 12 as revised wef 22 nd September 1997 to the Provident Fund Account.

A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952. Employees work in return for wages which can be paid on the. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly.

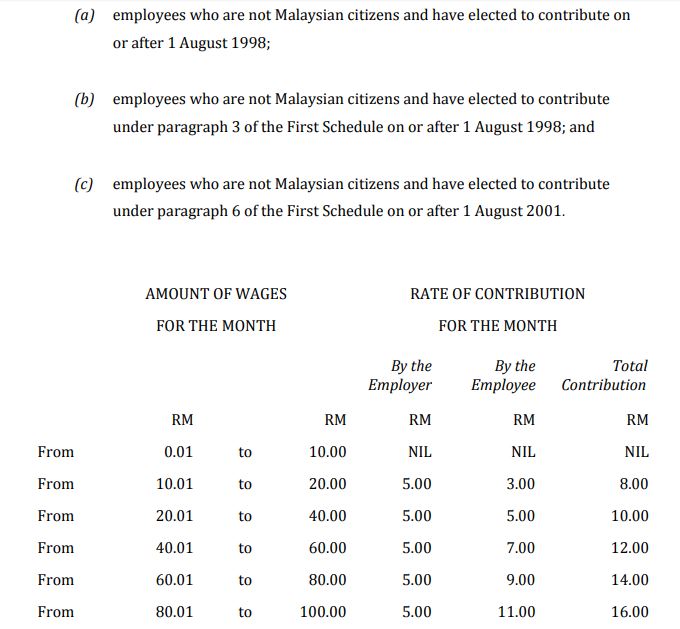

Employee Pension Scheme EPS 833. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age.

Based on the Contribution Rate within the Third Schedule the employers contribution should be RM756 12 while the employees contribution stands at RM567 9. However where employers share of EPF contribution is part of the CTC at 12 per cent rate in such a scenario an employee can request hisher employer to keep the contribution at 12 per cent for May June July 2020 instead of paying out the differential 2 per cent amount as salary to the employee. Key Points about EPF Contribution.

Even if youre back to full-time employment with EPF contribution from you and your future employer you can still make additional EPF contribution through self contribution. Presently the following three schemes are in operation. Of the two amounts viz.

Reduction of damages for delayed payment of provident fund dues proper if imposed without ascertaining the case. UPDATE. EPF Contribution Rates for Employees and Employers.

But for i-Saraan you need to inform EPF that you wish to apply for i-Saraan so that youre entitled to the 15 matching incentive from our government maximum RM250. If you need more flexible and better payroll calculation such as generating EA Form automatically or. Look for a break up of total taxable salary.

KWSP 3B 1 Savings Top Up Account 1. These contributions comprising the members and employers share will be credited into the members EPF account. KWSP - EPF contribution rates.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. 10 EPF share is valid for the organizations where there are 20 or less than 20 employees organizations with losses incurred more than or equal to the net worth at the end of financial year organizations declared sick by the Board for Industrial and Financial.

Please quote your EPF member number or identification number. Government contribution is limited to members who are below age 60. Principal Employer will pay EPF contribution if contractor fails to deposit.

Register with the EPF as an employer within 7 days upon hiring the first employee. Register your employees as EPF members and keep their information updated. Can an employee opt out from the Schemes under EPF Act.

Im An Employer i-Akaun LOGIN. As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the EPF ensure orderly contributions and record keeping as well as comply with the existing policies and requirements. Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work.

12 Employers contribution includes 367 EPF and 833 EPS. This brings the total monthly EPF contribution to RM1323. Collect your employees share of EPF contribution and submit it to the EPF along with the.

Epf Reduces Minimum Contribution For Employees Above Age 60 To 4 Per Cent

Epf Contribution Table 2021 How To Calculate Your And Your Employera S Epf Contribution

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Sql Account Estream Hq Employee Epf Contribution Rate From 11 Reduced To 7 Effective From 1 April 2020 To 31 December 2020 Employer Epf Current Contribution Rate Not Change To

Employee Provident Fund Calculator Excel Template Msofficegeek

Things To Know About Employee Provident Fund Business Standard News

Budget 2022 Minimum Epf Contribution Of 9 To Remain Till June 2022 The Star

15 Best Free Epf Retirement Calculator Websites

Employer Contribution To Epf एम प ल य प र व ड ट फ ड सर व स एम प ल य प र व ड ट फ ड सर व स In Laxmi Nagar Delhi Pf Esi Registration Co Id 22958653273

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Contribution For Foreigner Payroll Hr Forum

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Epf Employee Provident Fund Eligibility Benefits Of Scheme Abc Of Money

Employer Contribution To Epf एम प ल य प र व ड ट फ ड सर व स एम प ल य प र व ड ट फ ड सर व स In Laxmi Nagar Delhi Pf Esi Registration Co Id 22958653273

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Scheme Epfo Structure Applicabilty Functions Services Tax2win

Employee Epf Contribution Rate Reduced Form 12 To 10 Workforce Blog

Comments

Post a Comment